132

132

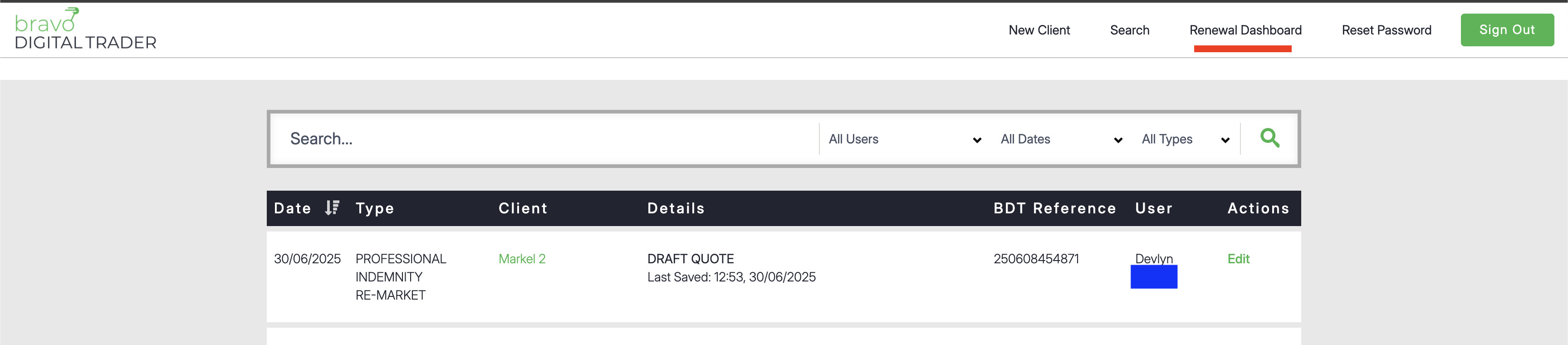

Managing Policy Renewals

The Bravo Digital Trader (BDT) platform proactively identifies policies approaching their renewal date. The system begins tracking a policy for upcoming renewal 45 days before its renewal date. This initial identification is separate from the specific renewal invitation dates issued by individual insurers.

You will receive a Renewal Notification Email each week. This email provides a summary of policies that are approaching their renewal date or those that have recently lapsed. These regular updates help you stay on top of your renewal pipeline.

Accessing and Reviewing Renewal Opportunities

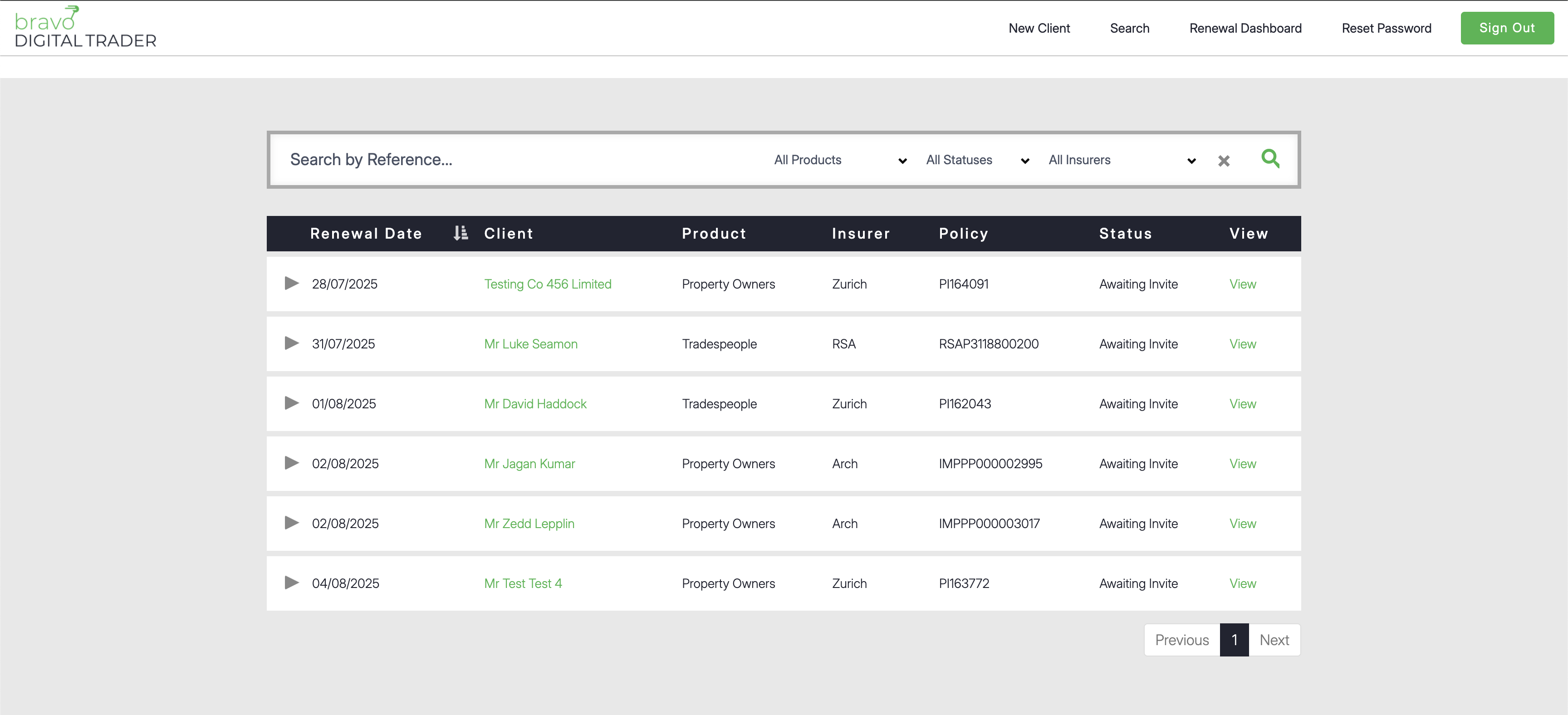

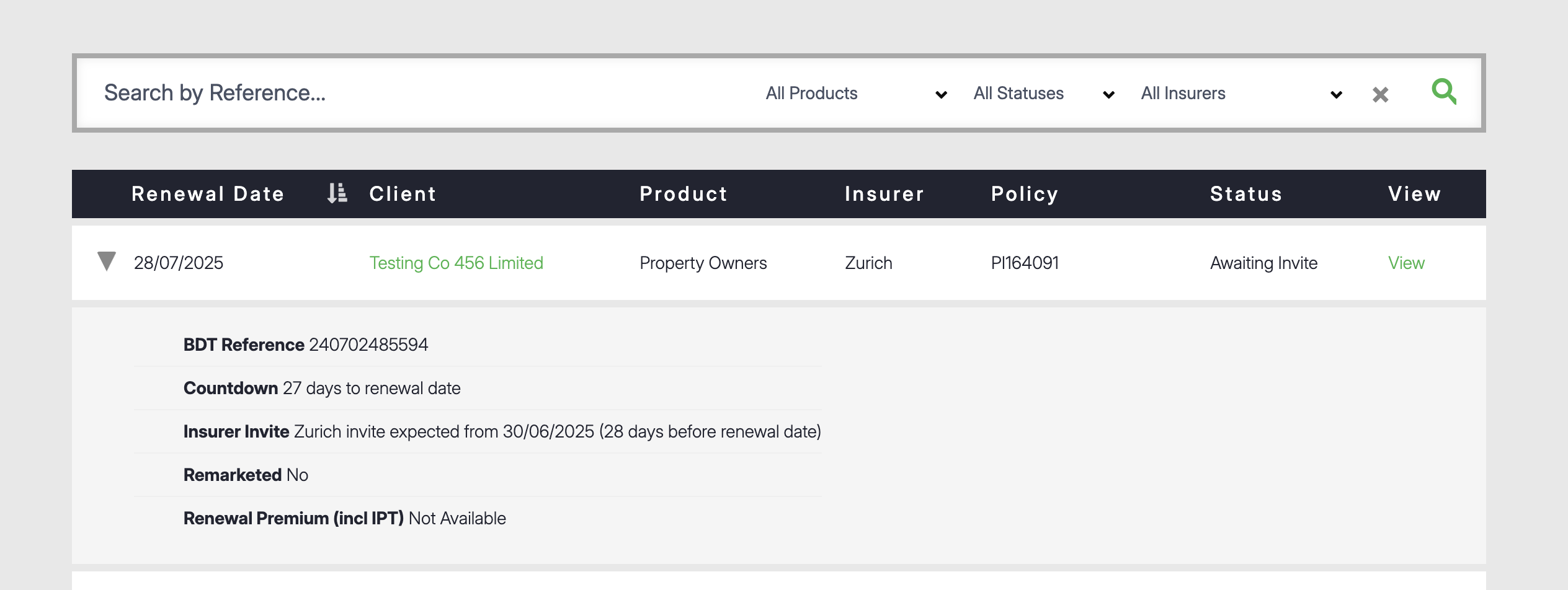

All your upcoming and recently lapsed renewal opportunities can be found on the Renewal Dashboard page, conveniently linked in the header of the platform.

This dashboard provides a centralised view of all policies requiring your attention.

The dashboard and individual policy pages display critical information for each renewal, including the client's name, policy type, renewal date, and the current status of the renewal process.

You can easily filter and sort renewal opportunities on the dashboard by various criteria such as renewal date, policy type, or status, helping you prioritise your workload.

Initiating and Managing the Renewal Quote Process

-

Receiving and Applying Renewal Invites:

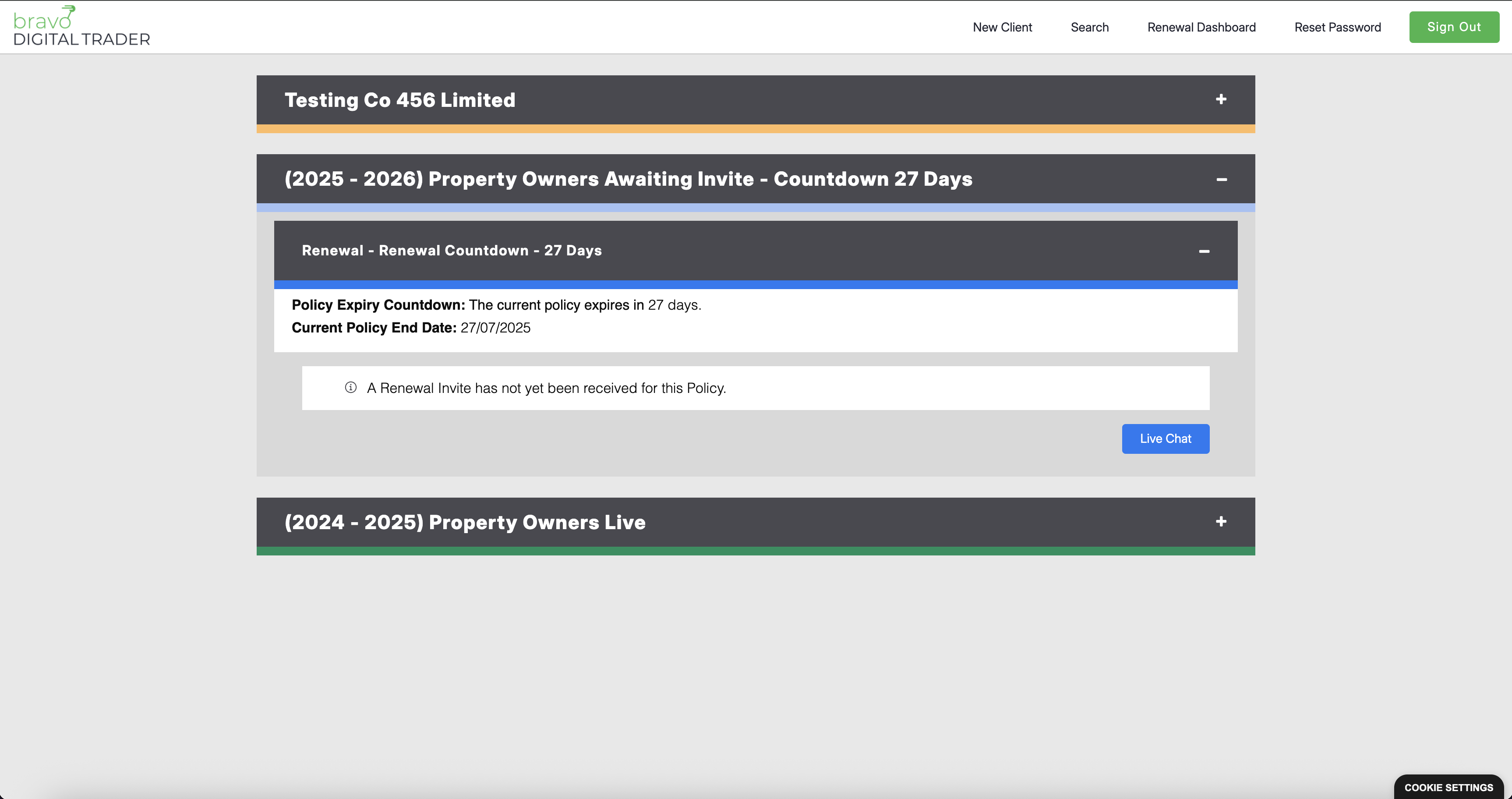

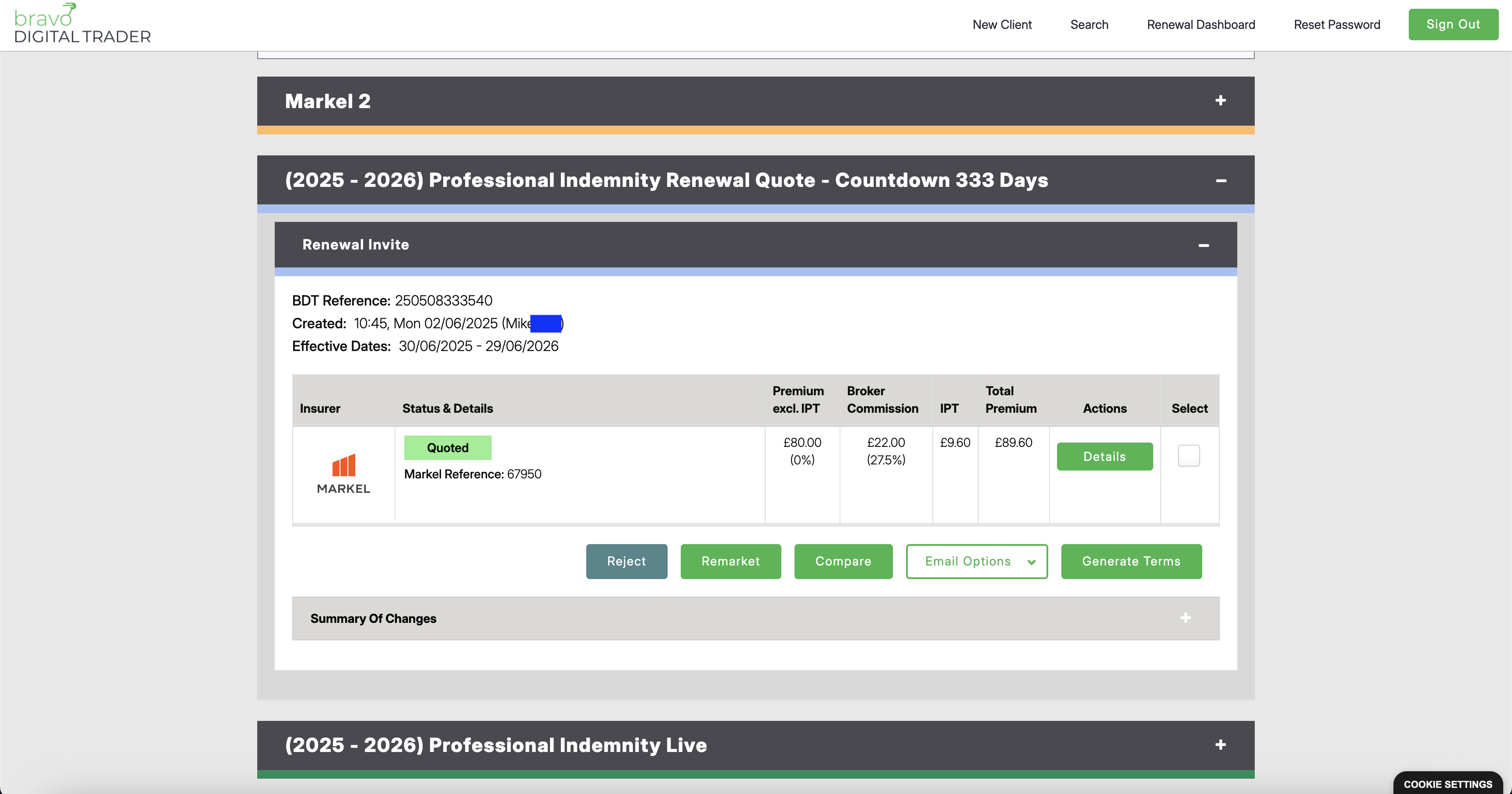

The Renewal Invite is initiated directly by the Insurer, not by the BDT platform. When an insurer issues a renewal invitation, BDT automatically applies this Renewal Invite to the relevant policy within your account. You do not have to do anything to receive or apply this invite within BDT.

A countdown to the renewal date is displayed

When the renewal invite is received from the Insurer, the actions bar on the Results Page will contain several options.

-

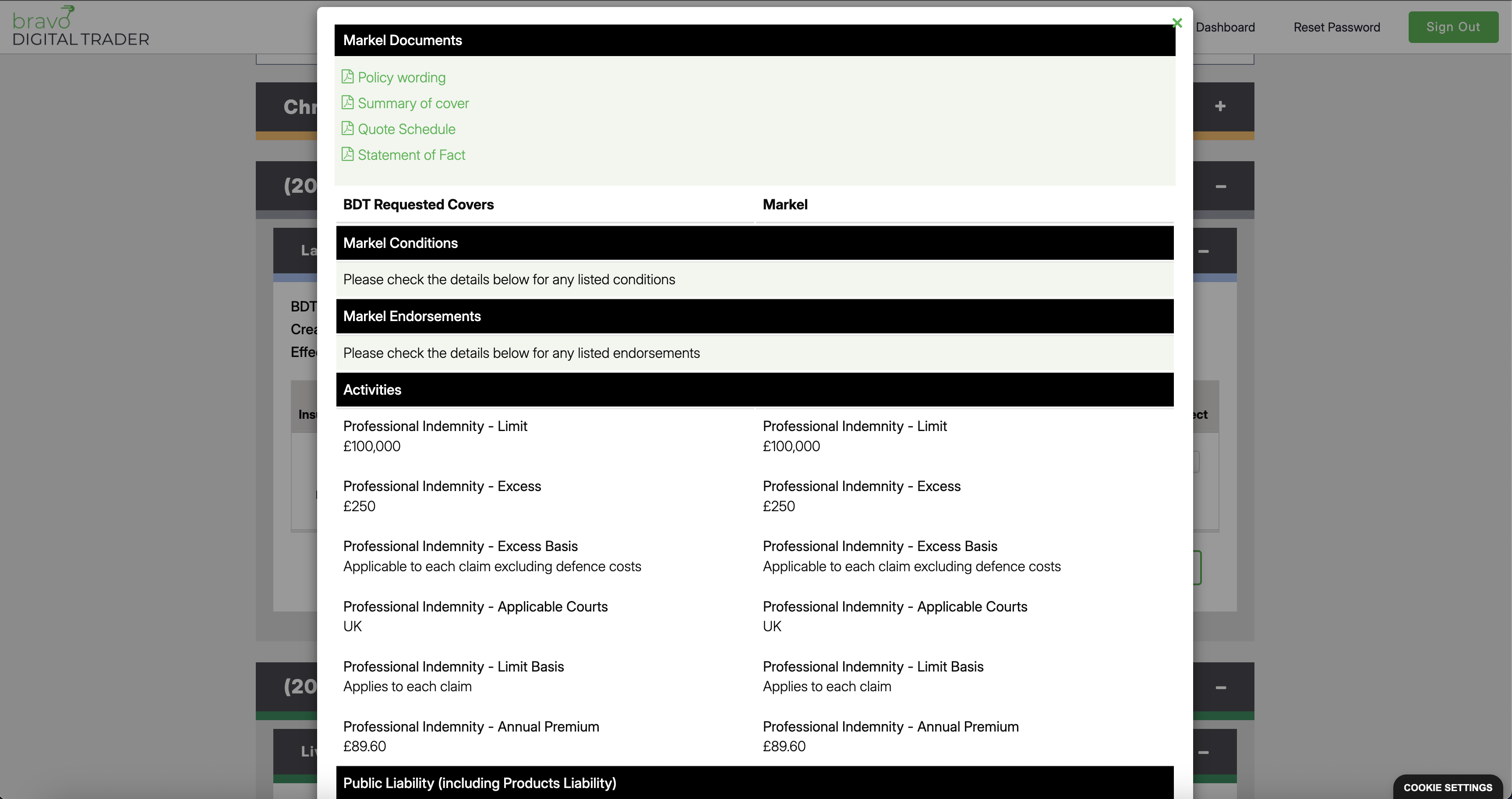

Generating Final Terms from Renewal Invites: For most insurers, simply receiving the Renewal Invite is the first step. To review the risk data and generate a final, bindable Renewal Quote, you will typically need to use the "Generate Terms" button (as seen above). This action allows you to finalise the offer based on the insurer's invite before presenting it to your client.

-

Remarketing for New Quotes: If the renewal terms aren't suitable, or you wish to explore alternative options, you can use the "Remarket" button. This allows you to remarket the policy to the full panel of insurers available, generating new quotes.

-

Important Note on Remarketing: The Remarket quote will include any uplift (e.g., increased premium or changes in terms) on the original Renewal Invite.

-

Quote Independence: Please be aware that changes made to the Remarket quote do not apply to the Renewal quote, and vice versa. These are separate quote streams. If you make changes to the original Renewal quote (e.g., updating risk data) and want these changes reflected in a Remarket quote, you would need to Reject the existing Remarket quote and create a new one to pick up the updated Renewal quote information.

-

-

Managing Mid-Term Adjustments (MTAs) During Renewal Period: You have the flexibility to create a Mid-Term Adjustment (MTA) for a policy even while its Renewal is still open. However, please be aware that binding the MTA will automatically reject the existing Renewal quote. In such a scenario, the insurer would then need to generate a new Renewal Invite based on the updated policy details from the MTA.

Post-Renewal Date Actions

A Renewal Quote remains actionable for up to 14 days after the official Renewal Date. During this period, you may still be able to bind the policy through BDT, though the exact ability to bind a lapsed policy varies by insurer and their specific terms.

At more than 14 days after the Renewal Date, the Renewal Quote can no longer be bound on BDT. At this point, you would typically need to generate a new business quote.